Compare Personal

Loans in Singapore

Find the Best Rates

Fast

Access low-interest loan offers from trusted lenders.

Apply securely via Singpass in minutes. No fees, no obligations.

Compare Loans Now

Why Compare Personal Loans with Money Kinetics?

We help you match with the best personal loan rates from trusted providers in Singapore, offering secure applications, fast approvals and no hidden fees.

Safe & Trusted Loan Matching

Get matched with trusted banks and financial institutions for a secure loan experience.

Fast Loan Application via Singpass

Apply quickly using Singpass for a fast, secure and hassle-free start.

Track & Manage Your Loan Easily

Easily manage your loan application from submission to approval with real-time updates.

Compare Rates from Top Lenders

Compare top lenders and secure a loan with low interest and flexible terms.

How Does Money Kinetics Work?

No stress, no paperwork. Just 3 steps to find your best loan — fast, secure and personalised.

Apply Securely with Singpass

Start by completing our online personal loan application using Singpass and MyInfo. It only takes 2 minutes with secure auto-filled details.

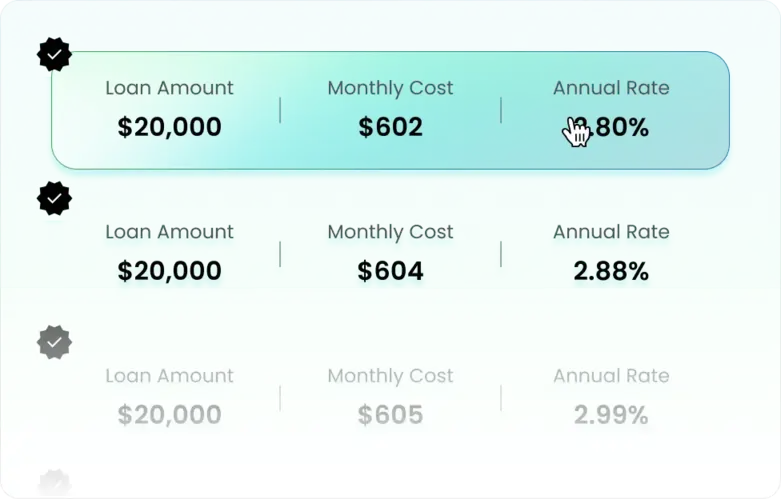

Compare Personalised Loan Offers

We match you with tailored options based on your profile. Compare interest rates, loan terms, and repayment flexibility to find your best fit.

Receive Your Funds Fast

Choose your preferred offer and book an appointment to sign the agreement in person. Your selected lender will disburse the funds, often on the same day.

Explore Your Personal Loan Options Now

-

Fast, Easy Application Process

-

Secure Match with Trusted Lenders

-

No Hidden Fees, Full Transparency

-

Dedicated Customer Support

Why Thousands Choose Money Kinetics?

Trusted by borrowers across Singapore for our speed, simplicity, and reliable loan comparison experience.

$ 330 M+

Loans Facilitated Annually

16,000 +

Borrowers Served Annually

5

Google Reviews

75%

Approved Within 24 Hours

Trusted by Over 16,000 Borrowers Every Year

Join thousands of satisfied borrowers who found the right loan through Money Kinetics. Your success story could be next.

Compare multiple lenders effortlessly and get the best personal loan with Money Kinetics today!

Compare Loans Now

Got Questions? We’ve Got Answers!

Still unsure about something? Browse our FAQs for quick, clear explanations.

Money Kinetics is an online loan comparison platform that helps you find the best personal loan offers in Singapore. With just one online application via Singpass, we match you with personalised offers from trusted banks and financial institutions. You can easily compare interest rates, terms, and choose the option that suits your needs best.

We are a registered company in Singapore and a recognised member of the Singapore FinTech Association (SFA). This affirms our commitment to transparency, data protection, and responsible lending practices. By working only with licensed money lenders and financial partners regulated by the Ministry of Law (MinLaw), specifically under the Registry of Moneylenders, and the Monetary Authority of Singapore (MAS), we ensure a safe and legitimate borrowing experience for every user.

A personal loan is an unsecured loan that you can use for a wide range of purposes, such as weddings, renovations, emergencies, debt consolidation or business needs.

Unlike a home or car loan, it does not require any collateral. Approval is typically based on your credit score, income and existing financial commitments. Personal loans are popular in Singapore for their flexibility and fast approval process.

Most loan comparison sites only show generic, advertised rates that may not reflect what you’ll actually receive. At Money Kinetics, we go further by matching you with personalised, pre-qualified loan offers based on your financial profile, all through a single application.

Instead of comparing static rates, you get real, tailored offers from banks and loan providers, making it easier to choose the option that best fits your needs. This approach saves time, protects your credit score, and ensures transparency at every step.

Plus, our support team is here to guide you from application to disbursement at no cost, giving you added confidence and peace of mind throughout the process.

Applying through Money Kinetics is faster, easier and more efficient than submitting applications to multiple lenders on your own. While you can go directly to a bank or loan provider, it limits your ability to compare actual offers. Submitting several applications may also affect your credit score.

With Money Kinetics, you only need to apply once. We securely match you with personalised offers from banks and licensed financial institutions, allowing you to compare rates and terms without affecting your credit report. This helps you find the best deal quickly and confidently.

Money Kinetics is not a loan provider, so we do not require a lending or banking licence.

We are a registered digital platform in Singapore that partners only with MAS-licensed banks and financial institutions. Our role is to help you compare and connect with trusted lenders through a secure and transparent process.

Money Kinetics is also a member of the Singapore FinTech Association (SFA).

Using Money Kinetics is completely free for borrowers. When you accept a loan offer through our platform, our partner bank or loan provider pays us a small referral fee. This allows us to provide you with a seamless and cost-free experience, without charging you anything directly.

Our goal is to help you find the best financing option, with full transparency and no hidden costs.

Eligibility for a personal loan varies across banks and licensed financial institutions. While Money Kinetics is not a lender and does not control approval decisions, we work with trusted providers who follow common criteria when evaluating applicants.

Here are the typical requirements:

- Age: You must be at least 21 years old. Some banks and loan providers may set a maximum age limit, usually between 65 and 70 years.

- Income: Requirements vary by lender. Most banks and loan providers require a minimum annual income of $20,000 to $30,000 for Singaporeans and PRs. For foreigners, the minimum typically ranges from $40,000 to $60,000.

- Employment: Most providers prefer stable employment of at least three months. Self-employed applicants may need to submit additional documents such as tax returns or income statements. Foreigners will also need to hold a valid work pass in order to apply.

- Credit Score: A good credit score increases your chances of approval and helps secure better rates. Money Kinetics does not perform credit checks, but our partner banks and providers may review your credit profile as part of their process.

Meeting these criteria can improve your chances of receiving competitive loan offers through our platform.

Most banks and loan providers in Singapore allow you to borrow between 2 to 6 times your monthly income, depending on your financial profile. The maximum loan amount is typically capped at $200,000. Your approved amount depends on factors such as your income, credit history and existing financial obligations.

Under the Total Debt Servicing Ratio (TDSR) rule, your total monthly debt repayments, including home, car and personal loans, must not exceed 55% of your gross monthly income. This regulation ensures responsible borrowing and helps protect your financial health.

To estimate how much you can borrow, you can use our personal loan calculator.

Repayment periods for personal loans typically range from 6 months to 7 years, depending on the bank or loan provider. The exact tenure offered will depend on your loan amount, credit profile and the terms set by the provider.

A longer repayment period usually means lower monthly instalments but a higher total interest paid, while shorter tenures can help save on overall cost.

The loan offers you receive through Money Kinetics are personalised based on your borrower profile. Factors such as your income, current debt, employment history and credit score all influence the interest rates and repayment terms offered by our partner banks and loan providers.

It’s important to note that advertised rates are usually general estimates. In most cases, they do not reflect the actual rates you will qualify for.

By using Money Kinetics, you can compare real, tailored offers from multiple banks and loan providers — helping you find the most competitive loan terms without needing to apply multiple times.

Most users get matched with personalised offers within 15 minutes, and around 75% of applications are approved in under 24 hours, saving you time and effort.

Once you accept an offer from a bank, the funds can be disbursed directly to your bank account, often within 15 minutes.

For offers from licensed loan providers, Singapore regulations require a face-to-face identity verification. In these cases, you will receive the funds immediately after visiting the provider’s office to complete the process.

No. You will be fully informed of all costs upfront. We show both the advertised interest rate and the Effective Interest Rate (EIR), which includes any processing or admin fees, so you know exactly what to expect before making a decision.

Using the Money Kinetics platform is completely free. There are no additional charges or hidden fees for submitting your application or comparing loan offers.

Yes. Your data is auto-filled securely via Singpass and MyInfo. We only partner with regulated lenders, so your application is encrypted and well-protected.

Money Kinetics uses a secure matching system that only shares essential, non-identifiable information with our partner banks and licensed financial providers to generate your personalised loan offers. Your full contact details are only shared after you accept an offer and choose to proceed with that provider.

All our partners are licensed and regulated by either the Monetary Authority of Singapore (MAS) or the Ministry of Law (MinLaw). This means they are legally required to comply with Singapore’s strict data protection and lending regulations.

Your privacy and security are our top priorities throughout the entire loan matching process.

No, using Singpass does not give us access to all your government data. When you log in with Singpass, you are only sharing the specific information you consent to, such as your name, income, and employment status, to help us match you with suitable loan options.

- Your data is never shared without permission

- Only essential details are used for loan assessment

- Singpass login ensures secure and accurate information transfer

Your privacy and data security remain fully protected throughout the process.

Applying for a personal loan through Money Kinetics is quick and secure. The entire process can take as little as 2 minutes.

-

Start your application

Visit Money Kinetics and choose to apply using Singpass or upload your documents manually. -

Submit your details

- With Singpass: Automatically pulls in your income, CPF contribution history, and residential address.

- Without Singpass: Upload the required documents manually through our secure platform.

-

Get matched within minutes

Your application is sent to over 50 banks and licensed financial providers. -

Compare your offers

Receive multiple pre-approved loan offers tailored to your profile. Compare interest rates, fees, and loan terms easily. -

Choose and proceed (if you wish)

Select the offer that suits you best. There is no obligation to accept. It is entirely up to you.

Tip: Use Singpass to save time and get more accurate results.

To apply for a personal loan with banks and licensed loan providers in Singapore, you’ll need to provide standard documents such as:

For Singaporeans and Permanent Residents:

- NRIC (front and back)

- Proof of income (latest payslip or CPF contribution statement)

- Proof of residence (e.g. utility bill, phone bill, or tenancy agreement)

For Foreigners (Work Pass Holders):

- Passport and valid work pass (S Pass, E Pass, etc.)

- Proof of employment (e.g. employment letter or work contract)

- Recent payslip or salary crediting record

- Proof of residence in Singapore (e.g. tenancy agreement or utility bill)

These documents help build your borrower profile and allow providers to offer you the most accurate and personalised rates.

These requirements are standard across the lending industry. We strongly advise against applying with any provider that does not request such documents, as they may not be licensed or regulated.

For a faster and more secure experience, we recommend using Singpass, which automatically submits these documents during your application.

Once you complete your application, Money Kinetics matches you with multiple personalised personal loan offers from trusted banks and licensed financial providers in Singapore.

You can then log in securely to your Money Kinetics dashboard to:

- Track your application status

- View a list of all matched loan offers

- Compare interest rates, monthly instalments, repayment periods, and any applicable fees

All offers are clearly displayed in one place, so you can compare side by side and select the best personal loan based on your financial goals and repayment ability, without the need to apply to each provider manually.

Tip: Submitting one application gives you access to multiple offers, saving you time and improving your chances of approval.

No, you are not required to take a loan after receiving the quotes. Using Money Kinetics to compare loan options is completely free and comes with no obligation.

- There are no hidden fees or charges

- You can review the offers and choose only if you’re comfortable

- It is entirely your decision whether or not to proceed.

You are in full control of the process from start to finish.

Money Kinetics partners exclusively with licensed and regulated financial institutions in Singapore. This includes major banks regulated by the Monetary Authority of Singapore (MAS), as well as licensed money lenders approved by the Ministry of Law (MinLaw).

By working with this wide network of trusted banks and licensed money lenders, we help you access safe, legitimate, and competitive loan offers, all conveniently through a single, secure platform.

Yes, a personal loan in Singapore offers flexible usage and is not restricted to specific purposes like a car or home loan. You can use the funds for almost any personal or financial need, including:

- Home renovations

- Wedding expenses

- Medical bills or emergencies

- Household or daily expenses

- Debt consolidation

- Business-related costs (if allowed by the lender)

How you use the loan is generally up to you, as long as it complies with the terms and conditions set by your bank or loan provider.

Tip: Always check with the lender if you have a specific purpose in mind, especially for business or investment use.

If you have questions that weren’t answered in our FAQs or need further assistance, feel free to reach out. You can email us at [email protected] and our team will be happy to help.

Alternatively, you may visit us by appointment only at:

Money Kinetics (Singapore) Pte. Ltd. (UEN: 202446017D)

- 41 Jalan Pemimpin, #04-1A Kong Beng Industrial Building, Singapore 577186

Money Kinetics's Blog

Your go-to guide for loan tips, money advice, and smarter financial choices.

Ready to Get Your Loan?

Start your journey with a quick, secure, and obligation-free application. Compare rates, pick your best match, and get funded fast.

Compare & Get Matched InstantlyFast Fund Disbursement

Loan Offers in Just 15 Minutes

No Hidden Fees, No Upfront Costs